There are many ways to invest and grow your savings. Unfortunately, there are just as many opinions on which investment is the best choice at any moment in time. Adding to the confusion, the most outspoken commentators may have incentives that influence their viewpoint.

In this article, we are going to look at look at two wealth building heavy-weights, stocks and residential real estate. They each have their own pros and cons, as well as fervent promoters.

Before making a meaningful investment in any risky endeavor, one should first consider their current financial position, goals and objectives, time horizon, liquidity needs and risk tolerance. What may be suitable for one person, may not work for another. If you would like to discuss your current investment approach, schedule an introductory meeting here.

Returns

Long-term returns of the stock market are often quoted between 8-10%. This varies based upon the index and time horizon. From 2011 to 2020, the annualized total return on the S&P 500 was almost 14%, pushing valuations to historically high levels. All else equal, paying a higher price today will result in lower returns in the future. Many fear future stock market returns will be lower than the 8-10% realized historically.

Since 1953, residential real estate prices have increased 4-5% per year. Not very exciting, but this is not actually the return that would be earned by an investor. The appreciation of the property is just one source of return. Below are some other drivers:

Leverage: Properties are often purchased with a mortgage, reducing the capital invested

Cashflow: Investors typically target properties that produce positive cashflow (collected rental income is greater than all expenses and reserves)

Amortization: The tenant is paying down your mortgage for you, increasing your equity in the property

Inflation: Rent, in addition to the value of the property, should increase over time, while your debt service remains the same, assuming a fixed mortgage.

Here is a simple illustration that demonstrates what an investors experience could look like:

| At Purchase | 5 years later | |

| Home Purchase | $500K | $623K |

| Mortgage | $400K | $397K |

| Equity | $100K | $226K |

| Profit after 6% Selling Costs | $89K | |

| Annualized Return | 13.6% |

An investor purchases a home for $500K and puts down 20%. The rental income is enough to offset all of the expenses associated with the property. They decide sell the property after 5 years, over which the property has appreciated by 4.5% per year. After deducting 6% in expenses related to the sale, the investor would be left with $189K. A gain of $89K on the original $100K investment, or a 13.6% annualized return.

While the home itself only increased a 4.5% rate, the use of leverage resulted in a gain 3 times that amount. If the property created positive cashflow, the returns would be even higher.

Liquidity

Liquidity describes how quickly and investment can be converted to cash. The stock market, generally speaking, is very liquid. In 2020, the average daily volume of stock trades totaled $10.9 billion. While the price of a stock may fluctuate wildly at times, most stocks can be bought and sold with a click of your mouse for the price on your computer screen. Furthermore, most brokerages have eliminated transaction costs on individual stocks and ETFs.

While the single-family housing market is generally viewed as the most liquid segment of the real estate market, it still takes weeks, if not months, to convert a home to cash. According to Zillow, in 2020, the average home spent 25 days on the market, plus another 30-45 days to close. That means it took 55-70 days from the start of marketing to close. Also, note that this timeline does not contemplate the time spent preparing for the sale or making any necessary repairs.

While liquidity is generally viewed as a positive characteristic of an investment, it can also promote bad behavior. Investors tend to feel losses twice as acutely as gains in their investment portfolio. Also, the fight or flight instinct that protects us from facing down a bear in the wild, does a horrible job of keeping us invested for the long term during a market downturn.

Volatility

Stock prices change minute by minute and can be higher one day and lower the next. Real estate prices, on the other hand, tend to trend higher or lower for longer periods of time. According to the Motley Fool, the stock market experiences a correction of 10% or more, on average, every 1.87 years.

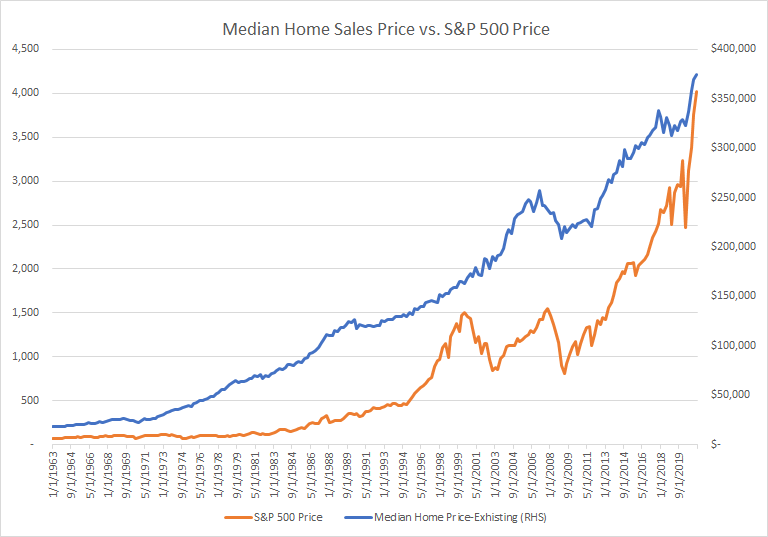

Since 1963, the median sales price of existing homes experienced a YoY decline of 10% or more on only two occasions. One of those periods was the housing crisis from 2007 to 2009, where the median sales price dropped 19%. While this period was hardly a walk in the park for an investor that bought a home using a mortgage in 2007, it is clear that on an aggregate basis, housing has been less volatile than the stock market.

Source: Link: https://fred.stlouisfed.org

Diversification

The price of an individual stock can change for a variety of reasons that may or may not have to do with the movements of the overall market. To reduce this company specific volatility, investors are encouraged to own a handful of stocks, ideally with different characteristics. Doing so minimizes, or diversifies, the risk that any one company or industry could materially impact the performance of the portfolio. This can easily be achieved by purchasing an ETF or index fund that owns a broad array of stocks and does not require a large amount of money.

Achieving diversification through rental properties is more difficult. Besides the money required for multiple down payments, you would want your portfolio to be geographically diversified. That means educating yourself on different areas, developing relationships with local professionals, additional legal and tax expenses and various other complications.

While there are other investment options, such as publicly traded REITs or eREITs offered through crowdfunding platforms, that allow for investors to achieve diversified exposure to real estate, diversifying a stock portfolio is still much easier.

Time and Effort

If an investor wants to do company specific research and trade their holdings, stock investing can be very active. That being said, most people buy a few individual stocks and index funds, sit back and watch their account value change over time. For these investors, stock investing is as passive as it gets. Other than periodically refreshing their account value, they put no effort into the success of the investment. Behind each stock is a board of directors, management team and countless employees that are all working to create value for shareholders.

Despite the common perception that you will be fixing toilets at 2 a.m., owning a rental property can be very passive. Yes, there is a lot of upfront work that must be completed to identify and purchase the property. For example, an investor must put together their team of professionals (broker, property manager, insurance agent, lender, etc.), research a market, find an attractive property, form an LLC, apply for a mortgage, open bank accounts and track income and expenses.

It is a lot of work to do it correctly, but once the upfront work is complete, a property manager can handle the day-to-day operations of the property. A good property manager will lease the property, communicate with the tenant, schedule maintenance, collect the rent and evict problem tenants. Occasionally, the property manager will reach out for approval to address an issue at the property, but most months the money just shows up in your bank account.

Conclusion

Should you invest your savings into the stock market or buy that rental property you have been eyeing? The truth is, it depends on the individual. The stock market and real estate have both created a lot of wealth for people. There have also been investors in both sectors that were not successful. Personally, I like to do both! In a world where interest rates are so low that traditional fixed income is more about capital preservation than income generation, rental properties are attractive for their income and inflation protection.

Before moving forward with any investment, make sure that your personal finances are in order and that you have a well-defined plan.