In recent years, some investors have questioned the merit of diversification during the prolonged U.S. tech-dominated bull market. With American tech giants delivering extraordinary returns, international investments sometimes seemed unnecessary. Furthermore, rising interest rates created a scenario, in 2022, where bonds failed to provide their traditional protection during stock market declines.

However, 2025’s market volatility offers a powerful reminder of why diversification remains a cornerstone principle of sound investing.

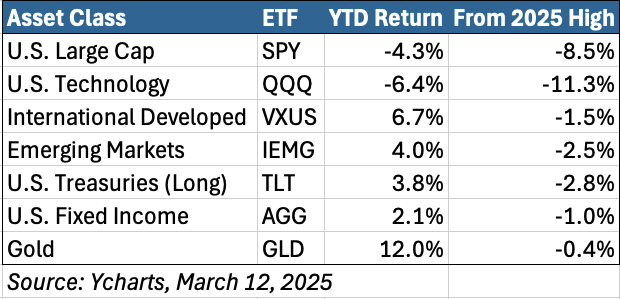

Market Performance Snapshot (March 12, 2025)

Key Insights

- Geographic Diversification Pays Off: While U.S. markets have struggled, international and emerging markets have demonstrated remarkable resilience, close to their year-to-date highs.

- Fixed Income Provides Balance: As economic concerns have grown, yields have declined, boosting bond prices. Longer-dated Treasuries and broad fixed income indexes have delivered positive returns, providing essential stability during the equity volatility.

- Alternative Assets Shine: Gold emerged as a standout performer in 2024 and has built on those gains with a 12% year-to-date return, reinforcing its reputation as a portfolio hedge during uncertain times.

The Bottom Line

A diversified portfolio, comprised of 40% SPY, 15% VXUS, 5% IEMG, 35% AGG, 5% GLD, has gained approximately 1% year-to-date, compared to a 4% loss for the S&P 500 alone.

While equities historically outperform bonds and gold over extended periods, capturing these superior long-term returns requires staying invested through inevitable market turbulence. Proper diversification smooths portfolio volatility, making it psychologically easier to maintain your investment strategy during challenging market conditions.

For assistance building a diversified portfolio tailored to your unique goals and risk tolerance, start here.

Disclaimer

The views and opinions expressed are for informational and educational purposes only as of the date of writing and may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. All investments carry a certain degree of risk and there is no assurance that an investment will provide positive performance over any period of time. Equity investments are subject to market risk or the risk that stocks will decline in response to such factors as adverse company news or industry developments or a general economic decline. Debt or fixed income securities are subject to market risk, credit risk, interest rate risk, call risk, tax risk, political and economic risk, and income risk. As interest rates rise, bond prices fall. Non-investment-grade bonds involve heightened credit risk, liquidity risk, and potential for default. Foreign investing involves additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. Past performance is no guarantee of future results.