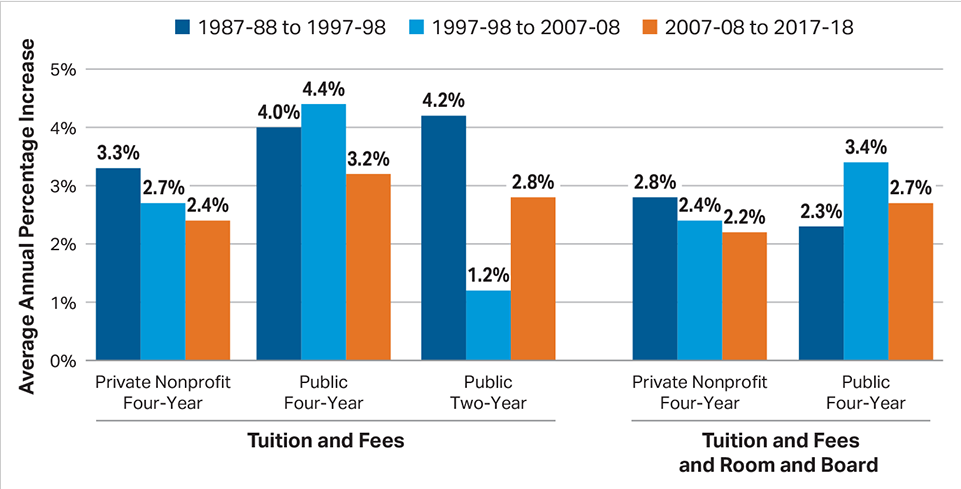

The growth in the cost of attending college has outpaced both general inflation and wage inflation over the last 30 years. According to the College Board, the cost of attending a pubic, four-year institution grew 3.2% faster than inflation between over the last decade. This outpaced growth is a major reason why so many young adults are saddled with student loan debt. The high debt burden, and the lack of financial security it brings, has been associated with a delay in life events, such as marriage, having a child, or buying a home.

With the growing popularity of online degrees and a discussion around the cost-benefit analysis of attending college, there is hope that the inflation rate of higher education may slow down, but with the global job market growing increasingly competitive and globally mobile, the demand for advanced degrees is unlikely to drop. Without proper planning, most people will be forced to take out student loans to fund the cost of higher education.

For those Americans who have the ability to save and desire to reduce or eliminate the future financial burden of student loans, Section 529 of the Internal Revenue Code offers a tax-advantaged savings plan designed to help and encourage education saving. These plans are commonly referred to as 529 Plans. While there are two types of 529 plans, prepaid tuition plans and education savings plans, we will focus on the latter, as prepaid tuition plans are limited and not very flexible.

What is an education savings plan?

Education savings plans allow an individual to open an investment account to save for a designated beneficiary’s future “qualified higher education expenses”. Tuition and room and board are included, along with a variety of lesser expenses, such as the cost of a computer, software, and text books. Funds in education savings plans may also be applied to a beneficiary’s tuition at any public, private, or religious elementary or secondary school up to $10,000 per year.

Education savings plans are sponsored by state governments, but few have residency restrictions for the saver or beneficiary. The plans generally offer a handful of mutual fund, exchange-traded fund, and principal-protected bank products. Sometimes target-date funds are available that shift the asset allocation from aggressive to conservative holdings as the beneficiary approaches college age. There are a variety of enrollment, maintenance, and asset management fees at the plan and investment level, so be sure to review the plans offering circular to understand the fees and investment options.

Most states provide tax benefits for contributions to state sponsored plans, but there are no federal tax benefits at the time of contribution. Any withdrawals, inclusive of investment gains, applied towards qualified higher education expenses are released tax-free. Lengthening the investment time horizon maximizes the compounding benefits, so start saving as much as possible, as early as possible.

In the event of non-qualified withdrawals, the portion of the withdrawal attributable to earnings will be subject to state and federal taxes plus an additional 10% federal tax penalty. The principal portion of the withdrawal will not be subject to tax or penalty.

How much can you contribute?

There is no explicit limit on the amount of annual contributions one can make to a 529 plan, but the gift tax limit of $15,000 per individual applies to contributions in 2018. For married couples, both parents can contribute to the 529 plan, meaning a maximum of $30,000 can be contributed per child, assuming there have been no unrelated gifts made.

If there is a desire to front load contributions without triggering gift taxes, it is possible to make a “5-year election”. As long as a contribution of greater than $15,000 is made, the amount will be pro-rated over the next five years. Additional gifts can be made each year by the amount that the pro-rated amount falls below the annual gift tax limit ($15,000 in 2018).

Finally, states do set a total contribution limit that serves as an upper bound on how much can be saved in a 529 plan. Current maximum total contribution limits generally range from $300,000 to $500,000, but vary widely depending on the state.

The value of starting early

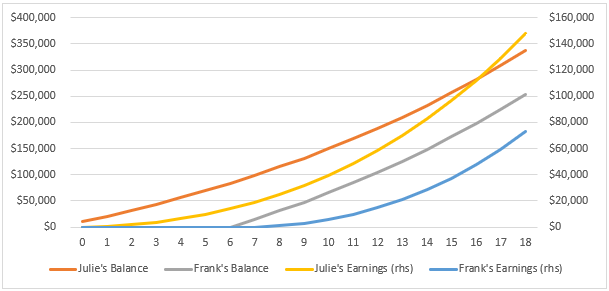

The below example illustrates how important it is to start saving early in order to maximize the compounding benefits of investing in a 529 plan.

Julie Saver contributes $10,000 when their child is born and then continues to do so at the beginning of each year until the child reached 18 years of age. Assuming her account earned a return of 6% per year, when her child turns 18, the account would have a market value of $337,600. Of that amount, $180,000 (53%) is principal contributions and the remaining $147,600 (47%) is attributable to investment gains.

Frank Spender does not have a financial planner and is not aware of 529 plans until someone brings up college saving at his child’s 7th birthday party. He is determined to make up for the delays and determines that he can contribute $15,000 each year until his child turns 18. Assuming the same 6% return per year, he will also have made contributions of $180,000, but the account’s value will only be $253,049, 25% lower than Julie Saver’s account and with 51% less investment gains.

529 plans and financial aid eligibility

Each educational institution may treat 529 plan assets differently, but need-based financial aid eligibility will likely be impacted. Furthermore, your eligibility for financial aid to at the elementary and secondary school level may be impacted by 529 plan assets, even if the intent is to utilize those assets for college. While it is likely that the tax-free compounding of the plan will outweigh these marginal impacts, you should have a discussion with your financial planner to review the costs and benefits of starting a 529 plan.

What to do with unused 529 funds

Whether your child receives a scholarship, forgoes a college education, or the costs were simply less than the amount saved, there are various ways to access unused 529 plan funds.

- Transfer funds to another beneficiary

A 529 plan beneficiary can be changed to another qualifying family member without tax consequences. Qualifying family members include parents, siblings, aunts and uncles, nieces and nephews, in-laws, spouses, and others in specific circumstances. Note that skipping a generation could trigger a tax penalty.

- Save funds for continuing education

After traveling the world for a year or taking a break to work with the Peace Corp, a beneficiary who originally decided to forgo a college education may ultimately decide that they want to attend college. Alternatively, the funds could be applied to a graduate or professional degree if the funds were not fully utilized pursuing an undergraduate degree.

- Penalty-free withdrawals

In a few cases, non-qualified withdrawals can be taken without incurring the additional 10% federal tax penalty. Investment gains will still be taxed at the state and federal level. These scenarios are the death or disability of the beneficiary, the beneficiary attends a U.S. Military Academy, or the beneficiary receives a tax-free scholarship.

- Pay the penalty and move on

Assuming none of the above scenarios apply, and there is no qualifying need in the foreseeable future, the funds can be accessed by paying state and federal taxes and the federal 10% penalty on withdrawals of any 529 plan earning. There is no time limit on how long funds can remain in a 529 plan, so other taxable funds that can be accessed without penalty should be accessed first.

In summary, 529 plans are not the only way to fund a college education, but given their flexibility and tax-advantaged features, they are one of the best tools available to college savers.