INTRODUCTION

Investing with a long-term focus has consistently been a successful strategy for wealth creation. Most people would not disagree with this point, yet we constantly find ourselves questioning what the market is going to do over the next few weeks or months. With the financial media and an increasing number of bloggers focused on attracting eyeballs to their websites, the number of sensational stories and “doomsday” predictions has proliferated. Do not fall into their trap. Even a broken clock is correct twice a day.

While the valuation of a company or security may ebb and flow, as long as companies are working towards earning and growing their profit, investors should be rewarded with positive long-term returns. At Mountain Vista, each individual portfolio is constructed in a manner to weather market downturns. Our tactical asset allocation strategy takes into account the needs and risk tolerance of each individual investor. This process attempts to fortify each investor’s portfolio against a liquidation in a time of market stress.

Investors who tuned out the calls for recession at the end of 2018 have been handsomely rewarded with substantial gains thus far in 2019.

Finally, a special thanks to all of our clients for their continued support. We remain focused on delivering long-term investment returns, while taking into account our clients’ goals and risk tolerance. As always, we are available to discuss any questions or concerns that you may have.

Sincerely,

Jonathan R. Heagle

President and CIO

OVERALL MARKET COMMENTARY

In the second quarter, the S&P 500 completed its recovery from the late 2018 correction. In June, the S&P 500 briefly made new highs, but it has since struggled to push much higher than 2018 high of 2930. The path from the Christmas Eve low was not a straight line and in May, the S&P 500 experienced a (6%) drop on growth and trade concerns.

For the third time in less than a year, the Federal Reserve came to the market’s rescue. The statement from the Fed’s June meeting noted “soft” business investment, inflation of less than 2%, and an increasing economic uncertainty. They said they will closely monitor incoming data and will act appropriately to sustain the expansion. While the average person would read those words and feel anything but reassured, the equity market rejoiced in the fact that the Federal Reserve is acknowledging the potential for economic weakness and is willing to provide additional stimulus in an effort to prevent any meaningful weakness.

Market expectations for future rate hikes have been eliminated and current pricing suggests that multiple rate cuts are likely. With the change in sentiment regarding the future path of interest rates, it should come as no surprise that the 10-year treasury rate has continued to fall to approximately 2%. As a reminder, the 10-year yield reached as high as 3.25% in 2018 with some market pundits calling for 4-5% long-term rates. Their predictions proved false and our expectations were confirmed, as the economy was not strong enough to support the higher level of interest rates.

In some ways the current investing landscape looks like it did over a majority of the last 10 years. Namely, a market characterized by low interest rates, a supportive Federal Reserve and pricey equity valuations. With the fiscal stimulus from the tax cuts wearing off, we will see if the old playbook continues to work or if a recession is in the near future.

EQUITY MARKET

Figure 1: Equity Index ETF Returns

| ETF | Description | Q2 2019 Total Return | YTD Total Return |

| SPY | S&P 500 | 4.2% | 18.3% |

| QQQ | Nasdaq 100 | 4.2% | 21.5% |

| IWM | Russell 2000 | 1.9% | 16.8% |

| IVW | S&P 500 Growth | 4.4% | 19.9% |

| IVE | S&P 500 Value | 4.0% | 16.6% |

| VXUS | International Ex-US | 2.8% | 13.4% |

| IEMG | Emerging Markets | 0.5% | 10.2% |

2019 has been a great year for equity investors, as all indices have positive quarter and year-to-date total returns. SPY (S&P 500 ETF) returned 4.2% in Q2, once again outperforming VXUS (International Ex-US ETF) and IEMG (Emerging Market ETF), which had total returns of 2.8% and 0.5%, respectively. IVW (S&P 500 Growth ETF) surpassed IVE (S&P 500 Value ETF) once again, but by only 0.4%. IWM (Russell 2000 ETF) was a notable underperformer as small capitalization stocks have been disproportionately hit by slowing actual and expected economic growth.

The strong returns mask some of the volatility that took place in May, as anxieties built around setbacks in the trade negotiations between the U.S. and China. The prospect of higher tariffs weighing down an already slowing economy caused the S&P 500 to fall by 6%.

While the trade tensions were blamed for the May sell off, the market was due for some consolidation after returning 17+% year-to-date through May 1st and approximately 25% from the low on Christmas Eve. Adding fuel to the fire, May is a historically weak month for equities. It is common for portfolio managers to trim their risk exposure heading into the Summer months. This activity resulted in the adage “sell in May and go away”.

Regardless of the reason for the weakness in May, the Federal Reserve was not pleased. At the June meeting they promised to provide support via rate cuts, if conditions warranted. This reiteration of the “Fed put” caused the market to unwind all of the May losses.

Where does that leave us now? To a large extent, the environment seems a lot like it did for most of the decade. Namely, low interest rates, an accommodative Federal Reserve, and seemingly expensive valuations. That environment went on to produce low returns for most fixed income and generally strong equity returns. However, the difference now is that we are coming off of a heaving dose of fiscal stimulus and are facing a slowing business cycle. Overall, this leaves us neutral equities with a bias towards less cyclical and defensive sectors.

With an accommodative Federal Reserve, relatively cheaper valuations and the potential for an amicable resolution to the trade negotiations with China, we still believe that Emerging Market stocks have an attractive risk-reward profile. With rates falling and the prospect for a slowing economy, we do not like financials. Finally, volatility in the healthcare sector is likely to pick up as the cost of healthcare will likely be a talking point for a number of Presidential hopefuls.

Figure 2: Equity Sector Returns

| ETF | Description | Q2 2019 Total Return | YTD Total Return | |

| XLF | Financials | 7.9% | 17.1% | |

| XLB | Materials | 6.0% | 17.0% | |

| XLK | Technology | 5.8% | 26.8% | |

| XLY | Consumer Disc | 5.1% | 21.2% | |

| XLP | Consumer Staples | 4.3% | 15.9% | |

| XLI | Industrials | 3.6% | 21.4% | |

| XLU | Utilities | 3.3% | 14.4% | |

| XLV | Healthcare | 1.4% | 7.9% | |

| IYZ | Telecom | (0.4%) | 13.1% | |

| XLE | Energy | (2.8%) | 13.0% |

XLF (Financial Sector ETF) was the best performing sector ETF with a return of 7.9% in the 2nd Quarter. This is somewhat surprising given the flattening yield curve and concerns of a slowing economy. It seems that easing credit conditions, brought about by the accommodative Fed, have been more important to the market than declining interest rates.

XLB (Materials Sector ETF) and XLK (Technology Sector ETF) were the next best performing sectors with returns of 6.0% and 5.8%, respectively. The three worst performing sectors were XLE (Energy Sector, IYZ (Telecommunications Sector) and XLV (Healthcare Sector), with returns of (2.8%), (0.4%) and 1.4%, respectively.

With the exception of XLE, the market laggards are the more defensive sectors. This should not come as a surprise given the strong returns of the market overall in the 2nd Quarter and the fact that the defensive sectors performed strongly during the market correction at the end of 2018.

FIXED INCOME MARKET

Figure 3: Fixed Income Returns

| ETF | Description | Q2 2019 Total Return | 2019 Total Return | |

| AGG | Aggregate Bond | 2.8% | 5.8% | |

| BND | Total Bond Market | 3.1% | 6.1% | |

| LQD | IG Corporate | 5.4% | 11.9% | |

| JNK | HY Corporate | 2.4% | 10.7% | |

| EMB | $ EM Bonds | 4.2% | 11.3% | |

| SHY | 1-3 Yr Treasuries | 1.4% | 2.4% | |

| IEF | 7-10 Yr Treasuries | 3.8% | 6.6% | |

| TLT | 20+ Yr Treasuries | 5.7% | 10.5% | |

| TIP | TIPs | 2.7% | 6.1% |

In the 2nd Quarter, fixed income continued to deliver strong returns. The Federal Reserve remains accommodative as global growth and inflation are subdued. LQD (IG Corporate Bond ETF) and TLT (20+ year U.S. Treasury Bond ETF) had the strongest performance, with 2nd Quarter returns of 5.4% and 5.7%, respectively. With the yield on 10-year U.S. Treasury Bonds falling from 2.4% to 2.0% over the last three months, it makes sense that these ETFs outperformed. LQD and TLT have the longest duration of the ETFs that we track. As a reminder, the price of a bond has an inverse relationship with interest rates. Duration measures the sensitivity of that relationship.

EMB (Dollar Emerging Market Bonds) also had another strong performance with a return of 4.2% in the quarter and 11.3% year-to-date. Declining domestic inflation should leave the door open for rate cuts in many emerging market economies. Also, an accommodative Federal Reserve should limit dollar strength, if not cause it to weaken.

JNK (High Yield Corporate ETF) continues to perform well with a 2nd Quarter return of 2.4%, bringing the year-to-date return to 10.7%. While there is more potential for credit spreads to tighten further, we believe it is a good time to trim exposure here.

Finally, with short-term rates likely to fall, we do not find floating rate bonds very attractive.

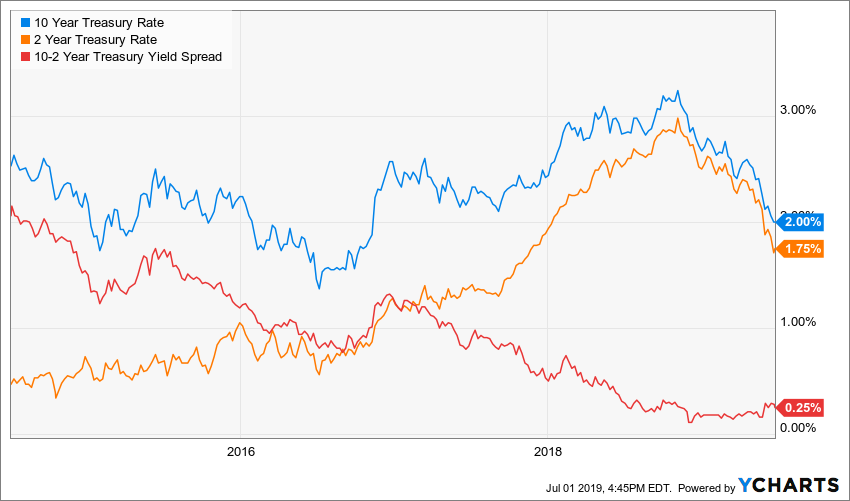

Figure 4: U.S. Treasury Yields

The decline of interest rates since late 2018 has been remarkable. The yield on the 10-year U.S. treasury bond has fallen from 3.25% in November 2018 to 2.0% at the end of the 2nd quarter. Despite the remarkable drop of 125 basis points in just over half of a year, the spread between the 2-year and 10-year U.S. Treasury has actually increased to 25 bps, from a low of 11 bps in November of last year. The fall in the 2-year Treasury Yield implies that the market is expecting the Federal Reserve to lower its target Fed Funds rate in short order.

With the large move lower in rates, the market positioning and narrative has flipped entirely. We do not find long duration fixed income very attractive at these levels. Absent an actual recession we would not be surprised to see long rates move higher from here.

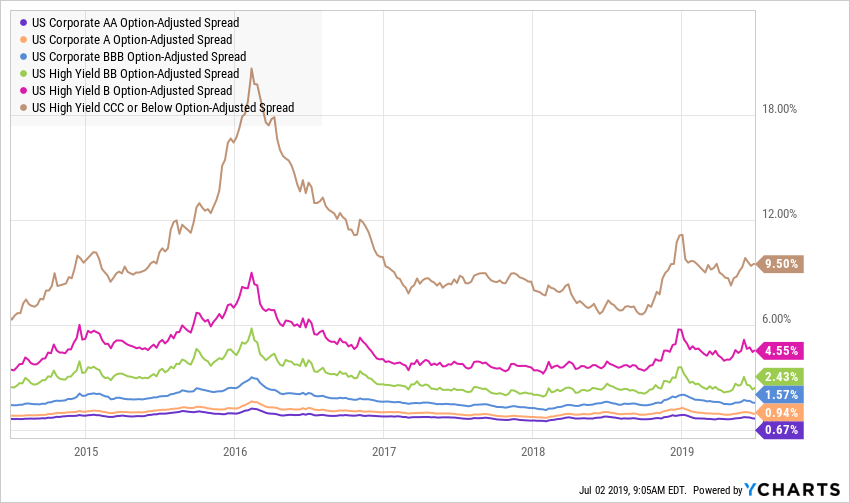

Figure 5: U.S. Corporate Credit Spreads

Corporate credit spread performance was mixed in the 2nd Quarter. Spreads of bonds rated BB or higher were flat to marginally tighter, but bonds CCC-rated and B-rated widened by 14 bps and 17 bps, respectively. This steepening of the credit curve is indicative of a market that has ample liquidity, but still fears a potential default cycle. This performance makes sense given that the Federal Reserve’s accommodative policies improve liquidity immediately, but it will take some time for the policy’s effects on the economy to show up in the data.

The still elevated spread levels of the lowest quality bonds shows that the credit sector is still concerned about a recession. Credit spreads are a powerful indicator of the strength of the economy. We would like to see CCC-rated and B-rated spread tighten inline with their higher rated counterparts. If the Federal Reserve can keep the economy growing, that could be the likely result.

CONCLUSION

With the strong returns posted in the equity market this year, one can forget how punishing the market can be. It is easy to let one’s guard down and take on more risk than they can handle. Remember it was only 7 months ago that the S&P 500 was 20% lower. Rather than chasing returns, now is the time to monetize some of the gains realized over the past six months and fortify the portfolio for what is ahead.

While the Federal Reserve has assuaged the market’s concerns for now, we still believe a slightly defensive posture is warranted. We are looking for ways to trim excess risk from the portfolio, while staying true to our long-term asset allocations. That being said, we will be looking for signs that the economy is picking up from lower interest rates.

Our focus is long-term value creation for our clients and creating investment portfolios that will perform within their risk appetite. The market will not always go up, but it is important to keep your eyes on the horizon and to ride out the short-term gyrations. We thank you for entrusting us with the responsibility of managing your portfolio and being a client of Mountain Vista.

Disclaimer

The views and opinions expressed are for informational and educational purposes only as of the date of writing and may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. All investments carry a certain degree of risk and there is no assurance that an investment will provide positive performance over any period of time. Equity investments are subject to market risk or the risk that stocks will decline in response to such factors as adverse company news or industry developments or a general economic decline. Debt or fixed income securities are subject to market risk, credit risk, interest rate risk, call risk, tax risk, political and economic risk, and income risk. As interest rates rise, bond prices fall. Non-investment-grade bonds involve heightened credit risk, liquidity risk, and potential for default. Foreign investing involves additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. Past performance is no guarantee of future results.