While stock indices are at or near their highs, it is easy to say that everyone should have just put their money into an S&P 500 ETF and kicked their feet up. After all, assuming the reinvestment of dividends, SPY is up 369% since the 2009 low. I say, why stop there? Maybe everyone should invest in the technology ETF QQQ. Since the 2009 low, QQQ is up over 600%. Who wouldn’t want those kind of returns?

When investing, it is important to remember that the path is as important as the destination. In the early 2000s, the S&P 500 lost 47%, with technology stocks down nearly 80%. During the financial crisis the S&P lost 55%, with financial stocks down over 80%. Finally, during the great bull market of the last 9 years, the S&P 500 saw corrections of 16%, 17%, 13% and 10% in 2010, 2011, 2015/16, and 2018, respectively. Most people have a hard time “staying the course” during these periods.

Historically, investors have made poor market timing decisions, buying when the market is expensive and selling when it is cheap. As human beings, we are prone to psychological traps and emotional responses. When the market is down 50%, a rational, long term investor should realize that it is a good time to invest, but most are probably doing the opposite to protect what remains of their wealth. According to DALBAR’s Quantitative Analysis of Investor Behavior , the average equity mutual fund investor lagged the S&P 500 by 3.3%, 2.9%, and 6.2% over the trailing 10, 20, and 30 years, respectively. DALBAR suggests that 50% of the underperformance is due to psychological factors.

While changing our emotional responses is difficult, if not impossible, defining an asset allocation strategy that is customized to our risk tolerance allows us to increase the odds of success.

Reason #1: Correlation

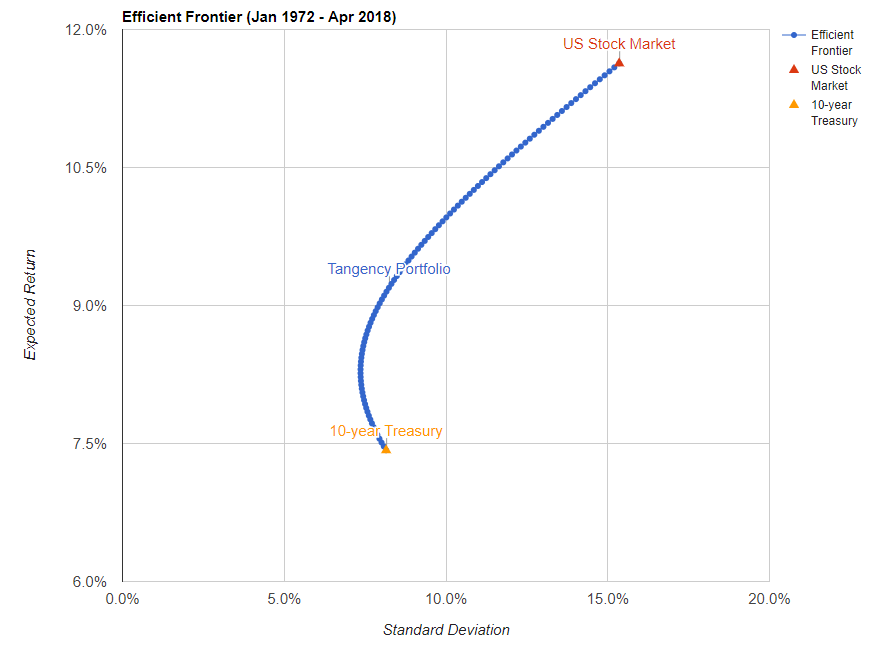

Most assets are not perfectly correlated and some are negatively correlated. By holding a number of different securities and asset classes, the overall portfolio becomes more stable. This is because it is unlikely that all assets will move in the same magnitude or even the same direction over a period of time. In the image below (generated on www.portfoliovisualizer.com), you can see that the risk, as measured by standard deviation, drops as you add stocks to a 100% treasury portfolio. This is the magic of diversification!

Reason #2: Asset allocation driven by your risk tolerance

Everyone reacts differently to a market correction and each investor’s portfolio should be tailored to their unique risk tolerance. An investor that is exposed to too much risk is prone to selling when the market moves against them. By altering the weighting of each asset class, we can change the risk and return profile of the overall portfolio (See here).

As an investment advisor, one of our main goals to is design an investment strategy that our clients can adhere to over the long run. While equities have the highest expected return over long periods of time, an all equity portfolio would not be appropriate for someone that is likely to sell after a 20% loss.

Reason #3: Programmatic rebalancing

Everyone knows the investment adage of “buy low, sell high”. While it sounds simple, it is hard to implement when we leave it up to our judgement and biases. The best way to guarantee that we adhere to this logical advice is to periodically rebalance the portfolio back to target allocations.

For example, assume a $100 portfolio is 50/50 stocks and bonds. If stocks go up 10% and bonds drop by 10%, the portfolio is now 55/45 stocks and bonds. To return the portfolio to target, you would sell $5 worth of stocks and buy $5 worth of bonds. Essentially, you’re buying bonds “low” and selling stocks “high”. In a trending market, this strategy will underperform a portfolio that did not rebalance, but when the trend reverses the portfolio will be aligned with the client’s risk tolerance and earlier gains will have been locked in.