Variable annuities are a popular alternative to traditional fixed annuity products. They seek to offer the safety net of a stable retirement income, but still capture the higher returns offered by equity investments. As the name implies, a variable annuity’s future payments can change based upon the performance of the investments held in the annuity’s sub-account.

During the accumulation phase, cash is collected from the investor and allocated into a mix of approved mutual funds. In theory, these funds grow over tax deferred over time until the investor determines that they would like to take a distribution. The investor can get either a lump sum distribution equal to the account value of their investments less fees, or they can receive a fixed payment over a period of time. The amount and duration of that payment can vary based upon the terms of the contract.

Variable annuities have various features and optional riders that appear very attractive on the surface. Based upon the situation, they may offer income tax deferral, exposure to the stock market, a guaranteed death benefit and a guaranteed minimum income.

If that sounds too good to be true, it may be. It should come as no surprise that insurance companies are in the business of making money and some of the benefits offered come at the expense of future returns. Let’s take a deeper look at some of the features of variable annuities.

Income deferral now, pay more later

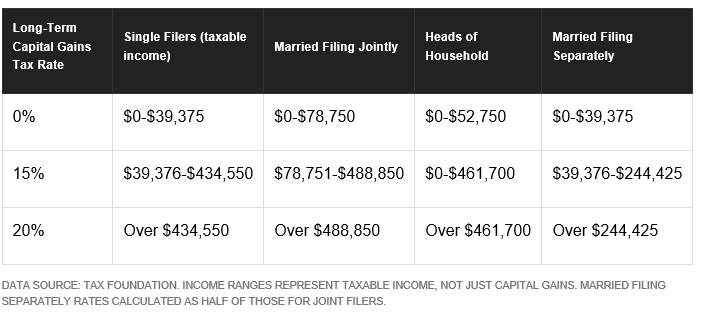

Owners of a variable annuity do not pay taxes on the income and investment gains generated by the annuity until they withdraw the funds. This allows your money to compound over longer periods of time before paying the IRS their due. This is where the sales pitch ends. When the funds are distributed, the gains are taxed at ordinary income rates, which can be as high as 37% in 2019. In comparison, gains on an appreciated stock held for more than 12 months would be taxed at long term-term capital gains rates that top out at 20% and are 0-15% for most income levels.

It is not uncommon for variable annuities to be purchased in an IRA. Since investments held in traditional IRAs already benefit from tax deferral, the deferral benefit offered by a variable annuity is irrelevant. Finally, unlike most investments that receive a step-up in basis upon your death, beneficiaries of an annuity continue to pay taxes as ordinary income based upon the original basis of the annuity. This will likely result in a less favorable tax situation for your heirs.

To summarize:

1) The income deferral benefit offered by a variable annuity during the accumulation phase may be offset by the higher tax rates applied to gains upon distribution

2) Variable annuities do not receive a step-up in basis upon death creating a potential tax burden for your heirs

3) All investments purchased in a qualified account benefit from income deferral.

Market-based, but not market returns

Insurance brokers claim that variable annuities give you exposure to the market while limiting the downside. This is technically true, but after factoring in the multiple levels of fees charged, you are likely better off just owning a low-cost diversified portfolio.

Variable annuities have multiple layers of fees that can vary considerably from policy to policy. Some are mandatory, such as the administrative, mortality and sub-account fund fees, and others are charged for optional riders. The cumulative effect of these fees can be quite substantial, resulting in a dramatic reduction in the value of your sub-account.

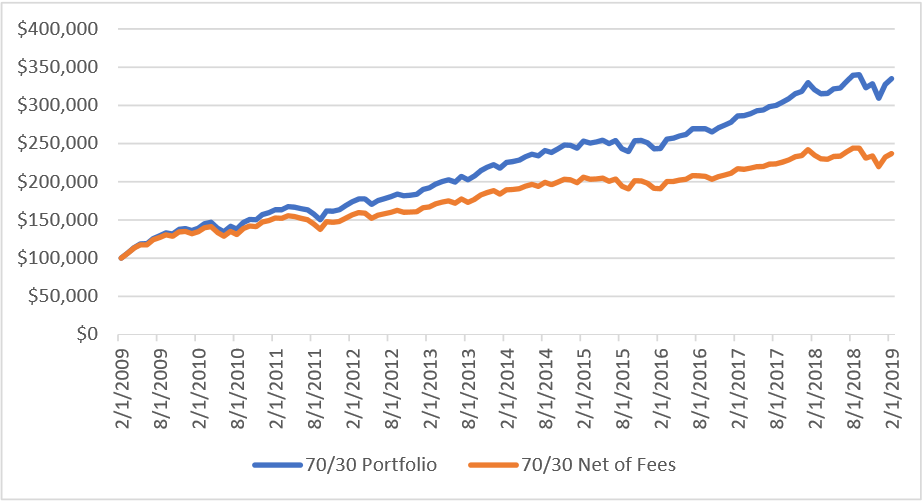

To illustrate the importance of expenses, let’s compare an investment of $100,000 in a portfolio comprised of 70% S&P 500 index and 30% Barclays Capital US Aggregate Bond Index, rebalanced monthly, over the 10 years ending in February 2019 to a variable annuity with a similar investment mix. The fees of the variable annuity are assumed to total 3.5% (breakout shown below). The “no fee” index portfolio would’ve grown to almost $335,000 while the annuity’s sub-account value was just under $237,000. This investor would have missed out on 41% of the market returns over the 10-year term.

| Variable Annuity Expense Description | Annual Expense |

| Mortality & Expense Risk | 0.70% |

| Administrative Fees | 0.15% |

| Optional Living Benefit Rider | 0.80% |

| Optional Death Benefit Rider | 1.10% |

| Sub-Account Manager Fees | 0.75% |

| Total | 3.50% |

High Surrender Fees

Variable annuities typically charge high fees to an annuitant that surrenders their policy in the early years. This period typically lasts 6 to 8 years with the surrender charge starting in the 7-8% range and dropping over time. The contract will typically permit withdrawal of 10-15% of the account value each year without incurring a surrender charge. The purpose of surrender charges is to allow insurance companies to recoup the sizeable commissions that were paid to the broker who sold the policy. Because of the steep surrender charges, variable annuities are not suitable for someone who may need access to their funds within a few years’ time.

Taking a look at some optional riders

Guaranteed Minimum Income Benefit (GMIB)

It is common for variable annuities to offer a GMIB to ensure some level of retirement income for the annuitant, regardless of the sub-account’s performance. The annuitant would be entitled to receive a fixed percentage of the benefit base after holding the annuity for a predetermined amount of time. This benefit base is typically equal to the initial account value and is guaranteed to increase by a fixed percentage for some period of time. As long as no more than the that predetermined amount is withdrawn in a given year, the annuitant can access those funds regardless of market performance.

It is important to note that the benefit base is different than the account value. The annuitant is not able to withdraw the benefit base and the account value is not guaranteed to increase by the same growth rate. This can be confusing as a purchaser of the variable annuity may think that they are getting a guaranteed return on their account value. Finally, this benefit can only be utilized if the contract is annuitized.

Guaranteed Minimum Withdrawal Benefit (GMWB) and Guaranteed Lifetime Withdrawal Benefit (GLWB)

Unlike the GMIB, these benefits allow the annuitant to access funds during the accumulation phase of the variable annuity. The GMWB guarantees that the annuitant can withdraw a predetermined amount of their premiums paid over a specified amount of time until the amount of the premium is returned. This guarantees access to the original premium amount regardless of the actual account value. For example, say you pay $100,000 for your annuity, you have access to a percentage of that amount each year until you have withdrawn a total of $100,000. Even if the account value has fallen below that amount.

The GLWB is similar to the GMWB, except there is no time limitation on the withdrawals. The annuitant may make these systemic withdrawals for life of the contract owner, regardless of the actual account value.

Summing it all up

Variable annuities are highly complex products with numerous features and benefits. They are not inherently inappropriate for all investors, but they are not appropriate for everyone and are rarely the most efficient way to achieve a given objective. Because of the high commissions paid to the selling broker, coupled with the complexity of the product itself, it is important to get the opinion of a fee-only advisor before finalizing your decision. As a reminder, fee-only financial advisors earn their fees by providing advice to their clients and do not receive commissions for the products they utilize.

Have more questions about variable annuities? Mountain Vista can help you determine if a variable annuity is the best option for you. Reach out to us here.