Ideally, your investment portfolio would be managed by a professional who is continuously optimizing your holdings over the course of the year, but for the “do-it-yourselfer”, here are 3 tips for your portfolio heading into the end of 2020.

To learn about how Mountain Vista can help you manage your investments and prepare for retirement start here.

Tip #1: Harvesting Capital Gains or Loses

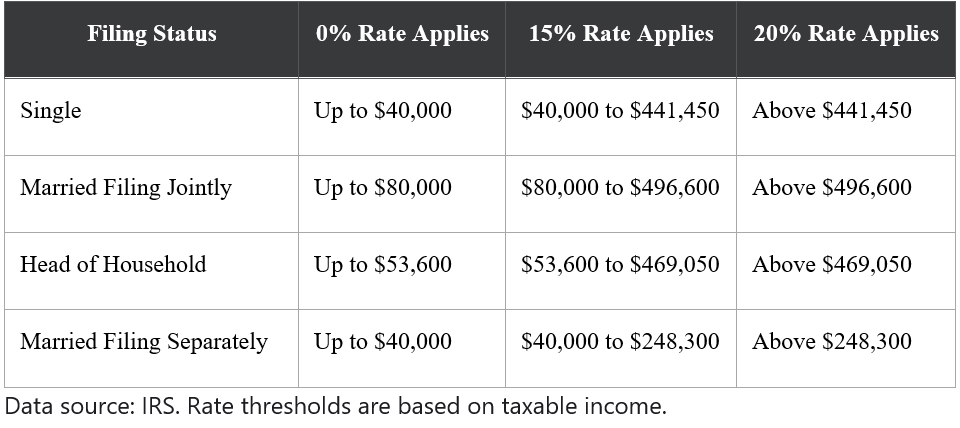

Based upon your level of income, it may make sense to realize a capital gain or loss to minimize taxes in the current or future years. Long-term capital gains receive preferential tax rates, as shown in the table for 2020 below:

If you are in the 0% tax bucket (Single <$40,000; MFJ <$80,000), you should consider realizing gains on positions held for more than a year until you reach the 15% threshold. A new position could then be opened, increasing the cost basis.

For tax payers that have capital gains and find themselves in the 15% or 20% brackets, selling losers to create offsetting capital losses may make sense. This strategy is particularly useful if the gains are short-term in nature, because short-term gains are taxed at the same rates as ordinary income. Someone in the highest federal income tax bracket of 37% (40.8% after factoring in the 3.8% net investment income tax) would see a reduction in their taxes of 41 cents for every dollar of capital loss generated.

Just be careful to avoid the Wash Sale rule by waiting over 30 days to repurchase a security sold for a loss. Also, note that gains and losses are first netted out against like-kind (long or short) and then the overall net short-term and long-term gains or losses are netted against each other.

Finally, if you’re a high earner, you may want to realize capital gains in 2020. While we do not know what tax policy will look like in 2021 and beyond, the Biden administration has floated the idea of taxing long-term capital gains as ordinary income for tax payers with income over $1 million. Furthermore, they have also discussed increasing the top tax bracket back to 39.6%. If you expect your income to remain high for the foreseeable future, realizing gains in 2020 may result in significant tax savings.

Talk to your CPA or tax professional to further explore whether these strategies would benefit you.

Tip #2: Rebalance Your Portfolio

Over time an investment portfolio will deviate from its initial asset allocation, as outperforming securities grow in value relative to underperforming securities. Left unchecked, the composition and risk profile of a portfolio shift over time.

To illustrate this effect consider the following example:

An investor has a starting asset allocation of 60% stocks and 40% bonds. Let’s assume that their stock holdings increase by 20% and bond holdings dropped by (-5%). At the end of the year, their asset allocation would now be 65% stocks and 35% bonds. The increased equity exposure makes the portfolio more susceptible to a correction in stock prices.

By selling a portion of their stock holdings and using the cash raised to purchase more bonds, they can “rebalance” their portfolio back to 60% stocks and 40% bonds.

In addition to maintaining the target risk exposure of the portfolio, rebalancing forces the investor to “buy low and sell high”. Too often, investors find themselves doing the complete opposite. Try rebalancing on a set schedule to remove the emotional element.

After a year like 2020, which brought us a (-35%) drop in the S&P 500 and a subsequent march higher to double digit year-to-date gains, it is likely that your portfolio looks very different than it did on January 1st.

Tip #3: Add International Exposure

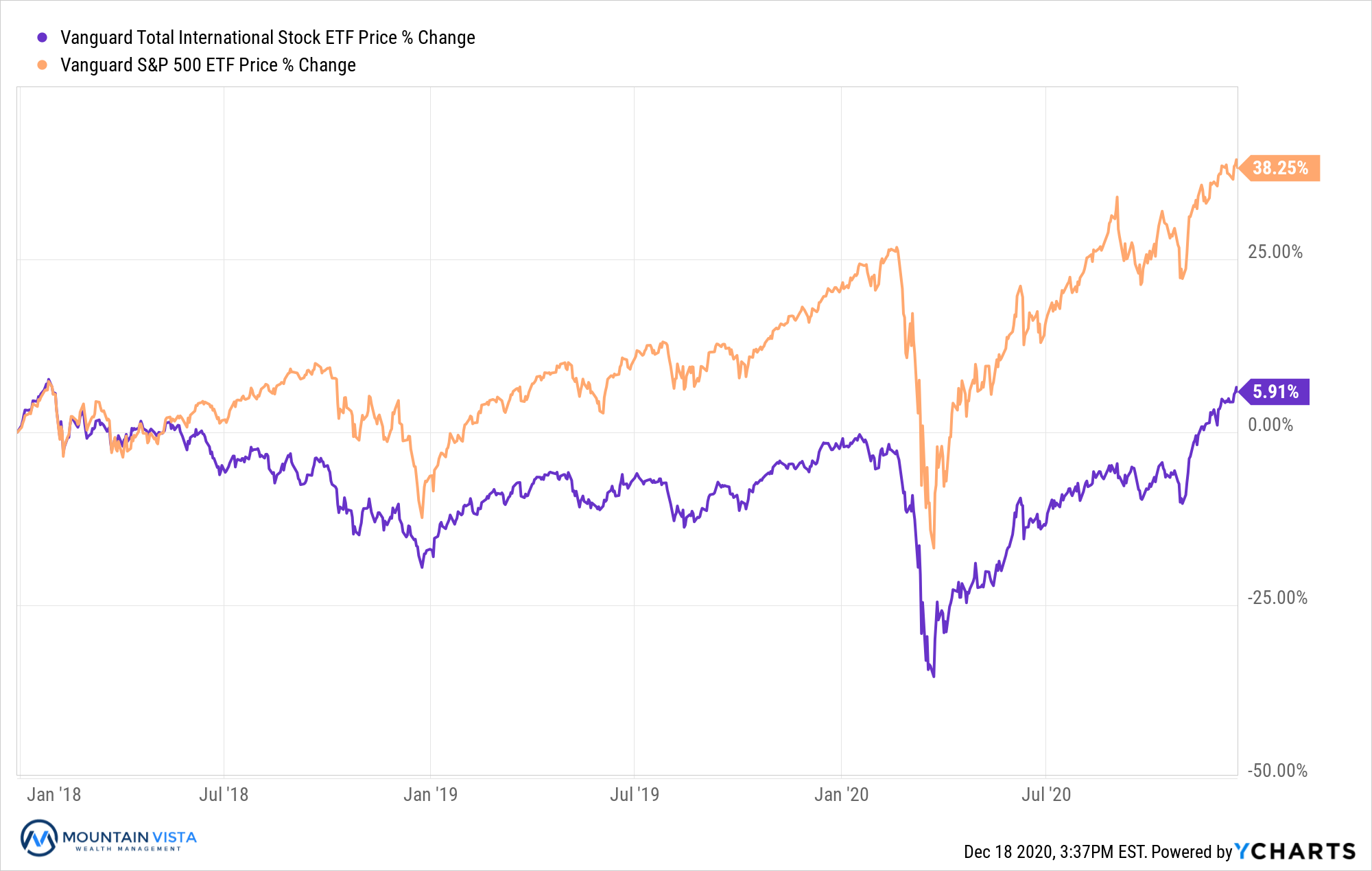

Adding international exposure may benefit your portfolio by improving diversification and increasing future returns. After significant outperformance over the last decade, U.S. equities are arguably rich to their emerging market counterparts. There are many arguments to justify this valuation gap, but all-else-equal cheaper valuations should result in greater future returns.

Most investors have what is called “home country bias”. This means our investment portfolios tend to be comprised of companies based in our “home country”. If you are a U.S. investor, this has worked out very well for you in recent years. The Vanguard S&P 500 ETF (VOO) has returned 38% from since the start of 2018, while the Vanguard Total International Stock ETF (VXUS) has only returned 6%, but will this outperformance continue?

According to the International Monetary Fund (IMF), the United States makes up roughly 16% of the world economy, down from 20% in 2000. During this period China grew from 7% to almost 19%. The IMF projects that Emerging Market economies will continue to grow for the foreseeable future. As the world continues to become more connected and technology makes working remotely more effective, where a company and its employees are physically located becomes less important.

While the U.S. capital markets have been very kind to capital over the last decade, the next 10 years may be different story, as least on a relative basis.

Connect with Jonathan Heagle, CFP®, CFA on LinkedIn or read about his story.

To learn about how Mountain Vista can help you manage your investments and prepare for retirement start here.