Over nine years have passed since the March 6, 2009 low in the S&P 500. Over that time SPY has gone on to produce a total return of greater than 400%. That should be cause for celebration, right? Apparently not if you write about the markets for a living.

Over nine years have passed since the March 6, 2009 low in the S&P 500. Over that time SPY has gone on to produce a total return of greater than 400%. That should be cause for celebration, right? Apparently not if you write about the markets for a living.

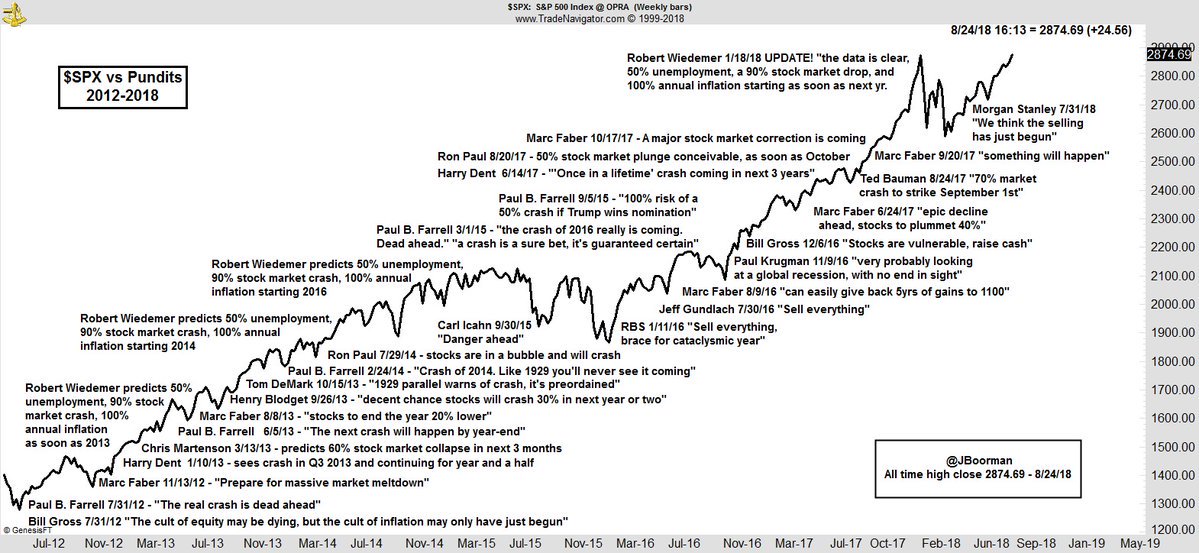

Consumers of financial media are constantly being bombarded with stories about the next market crash. Take a look at this chart of crash predictions over the last 7 years (shown below) or this one. Yet here we are nervously sitting at all time highs, biting our finger nails, and white knuckling the steering wheel of our investment portfolios.

Common knowledge among journalists was that a Trump victory would produce a market crash. Since November 4, 2016, SPY has produced a total return of over 40%. If you followed the advice of journalists and avoided market exposure, you not only missed out on a huge advance, but how do you justify buying now? At the time, no one was writing about the other investing risk, my biggest fear, that equity markets would continue to get more expensive making it even more difficult to justify allocating money to equities or continuing to hold onto existing positions. Loftier valuations theoretically make future returns even harder to achieve and any reversion to the historical mean would be that much more painful.

Why is financial reporting skewed so far to the negative side? Because positive stories do not generate the same amount of attention as shocking or negative headlines. There are also a number of “permabears” and doomsayers that comically continue to forecast a coming market apocalypse on a daily basis. This despite being wrong time and again (again see chart above). The most dangerous type are the ones with the savvy to present their views in a coherent and intelligent manner. It would be wise to remember that journalists, and even permabears, are incentivized to create content causes people to click on their link or buy their newspaper. They do not care about the performance of your investment portfolio and have no fiduciary duty to write content that is in your best interest.

People continue to get drawn to shocking headlines because they trigger our fight or flight response. It is almost impossible to ignore a sensational headline, even if you know it is silly. Furthermore, studies have shown that people dislike losses twice as much as they enjoy gains. This concept is known as loss aversion and it causes us to make poor decisions and act irrationally when faced with the prospect of a loss. Coupled with our instinctual fight or flight response, how can we ignore a headline forecasting a tremendous loss of wealth!

The point of this post is not to suggest that the market is going to go up forever or that it cannot crash next year. Eventually the stock market will suffer a meaningful decline, maybe even 30-50%. But you have to ask yourself at what time and from what level? Selling every time you read of a market crash or avoiding the stock market all together guarantees that your money will not generate the real return needed by so many retirees today and looking forward. Creating and adhering to an investment policy that is suitable to your goals and risk tolerance is the best way to maintain discipline and achieve positive, long-term returns.

Also, check out my article on the importance of investing to beat inflation.