Investing can be confusing and even scary to the average saver, but while staying in cash may give you a sense of security in the short term, one is almost guaranteed to lose purchasing power over time. This is because of inflation, defined as a general increase in prices and the fall in the purchasing value of money.

Mainstream economists currently believe that financial system performs best with low, but positive inflation, as judged by the promotion of employment and economic growth. The Federal Reserve has long targeted price stability, but as of 2012, they officially announced a target of 2% inflation over the longer term.

Just as inflation is viewed as beneficial to the economy, deflation, or a drop in prices, is believed to be detrimental. Consumers put off buying goods that they believe will be cheaper in the future and business investment slows as companies experience less demand and find it more difficult to generate a positive return on capital. Finally, borrowed money becomes more difficult to service and payback. For these reasons, inflation is likely to remain positive in the future.

To illustrate the importance of inflation over time, consider that a good costing $100 in 1968, would cost $720 in 2018, if indexed to the Consumer Price Index. That is a cumulative inflation rate of 620%!

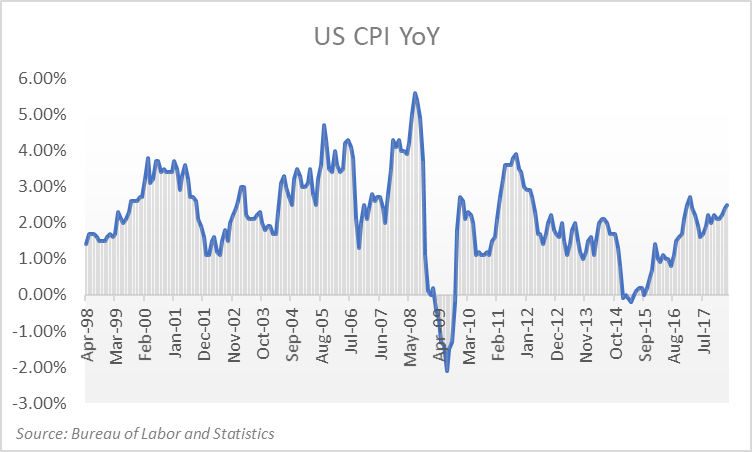

As you can see in the chart, inflation has recently been in the low single digits and the 20-year average is just over 2%, but looking back to 1913, the annual CPI has been greater than 10% 10% of the time and greater than 5% 24% of the time. An individual who simply “put cash under the mattress” would have seen a dramatic drop in their wealth during these periods.

Why should an investor care about inflation? Because it determines how much of their returns are an actual growth in purchasing power. Successful investing focuses on positive real, or inflation adjusted, returns. The nominal returns earned on your investments can be broken down into the real return plus inflation.

Rnominal = Rreal + Rinflation

If your investments are not earning the rate of inflation, your real return is negative, and the purchasing power of your money has been eroded. If your return is equal to the rate of inflation, you have simply maintained the purchasing power of your money.

The silver lining is that history tells us a balanced portfolio that incorporates equities and fixed income, should not only keep up with inflation over time, but have a positive real return (Rnominal > Rinflation). According to Vanguard, a 60/40 portfolio of equities and fixed income returned 8.8% annually between 1926 and 2017. During this period, the average annual CPI was approximately 3%, leaving you with a real return of approximately 5.8%. While the past does not guarantee future performance, particularly over short periods of time, the case for investing is clear when the alternative is a likely loss of purchasing power.

[…] Also, check out my article on the importance of investing to beat inflation. […]